VAT Services

At Emerald, we go beyond consultancy services and also offer VAT-enabled accounting software tailored

to suit the needs of businesses in Dubai, UAE, and the wider Middle East region.

VAT Registration

We offer expert guidance in the VAT registration process, ensuring businesses adhere to requirements and successfully register with tax authorities.

VAT Return Filing

Our team manages timely and precise VAT return submissions on behalf of businesses, alleviating administrative burdens and guaranteeing compliance with reporting obligations.

VAT Accounting

Leveraging our VAT accounting expertise, we assist businesses in maintaining accurate, up-to-date VAT transaction records, ensuring correct classification and treatment of VAT-related activities.

VAT Training

Our VAT training programs equip businesses and staff with the knowledge and skills needed to comprehend VAT regulations, meet requirements, and effectively manage VAT-related responsibilities.

VAT Invoicing

We provide guidance on VAT invoicing requirements, ensuring businesses issue invoices meeting criteria, contain all necessary information, and comply with VAT regulations.

VAT Consultants

Our seasoned VAT consultants provide valuable insights and guidance, aiding businesses in navigating complex VAT regulations, optimizing tax positions, and minimizing compliance risks.

VAT & Tax Consultancy in Dubai

In the realm of VAT and tax consultancy services in Dubai, our team is committed to mitigating the impact of local and VAT obligations while aligning with your business objectives. As trusted tax consultants in Dubai, we are backed by a highly skilled and experienced team of VAT experts who excel in guiding you through the intricacies of VAT regulations, ensuring compliance, and enhancing your tax efficiency. Our ultimate aim is to empower your business to operate seamlessly and efficiently by delivering the finest and most dependable VAT consultancy services in Dubai and the UAE.

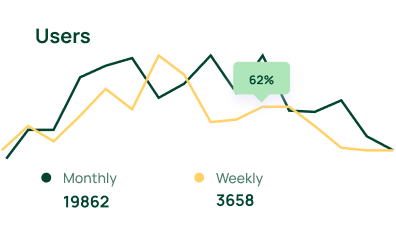

- VAT Registration

- VAT Compliance

- VAT Calculation

- Invoice Management

- Multi-Currency Support

- Tax Rate Updates

Core Services

Our software solutions are designed to streamline your accounting processes, making VAT compliance more manageable and accurate. With our VAT-enabled accounting software, businesses can automate calculations, generate accurate VAT reports, and ensure seamless integration with their financial systems.

-

Professional Services Portfolio

Our firm provides a range of professional services, including audit, accounting, VAT consultancy, and related solutions tailored to meet your specific needs.

-

Audit & Assurance Expertise

In Dubai, we specialize in delivering top-notch audit and assurance services, ensuring financial accuracy and compliance with regulatory standards.

-

Comprehensive Accounting Solutions

Our UAE-based accounting services are designed to efficiently manage your financial records, fostering financial clarity and stability.

-

VAT Consultancy Excellence

We excel in offering VAT services in Dubai, assisting businesses in navigating the complexities of VAT regulations and ensuring compliance.

-

Taxation Proficiency

Our tax services in Dubai encompass a wide spectrum of expertise, helping businesses manage their tax obligations effectively and efficiently.

-

Corporate Finance Excellence

We specialize in corporate finance services, providing strategic financial guidance and solutions to enhance your business's financial standing.

Take your VAT, Audit & Taxation

prowess to the next level

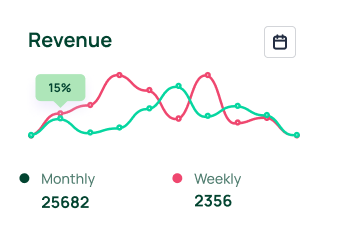

Rates of VAT

Rely on our expertise for accurate information and guidance on applicable VAT rates for different goods and services, ensuring pricing and invoicing compliance.

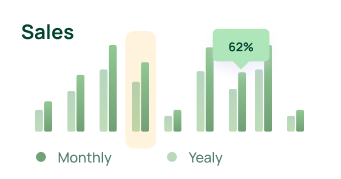

VAT Accounting Software

Access our advanced VAT accounting software to streamline processes, automate calculations, and ensure precise VAT reporting, enhancing efficiency.

Accounting Software Consultation

Our consultancy services in Dubai extend to accounting software, helping businesses choose and implement the right solutions to streamline financial processes.

VAT Strategy Development

Our expert team is equipped to assist you in formulating VAT planning strategies designed to reduce your VAT liability and enhance your cash flow.

Ensuring the security and confidentiality

of sensitive VAT-related data.

Internal Audit Services in the UAE

Our internal audit services in the UAE are integral in providing investors with assurance regarding the accuracy and dependability of financial statements. With a primary focus on financial audits, we strive to inspire confidence among stakeholders by conducting meticulous reviews of financial records, ensuring the accuracy of presented statements. Our independent and objective assessments contribute to the overall transparency and credibility of organizations operating in the UAE. However, our internal audit services extend beyond financial audits. We employ a comprehensive approach that encompasses assurance and consultancy activities, all aimed at adding value and enhancing the operational efficiency of organizations.

Annual Audit services in Dubai

When it comes to annual audit services in the UAE, our expertise and knowledge in the field enable us to provide top-notch auditing services in Dubai. We understand the unique requirements and challenges that businesses face, and our approach to annual audits is designed to be productive and business-oriented. Our team of specialists is committed to a dedicated effort. They aim to thoroughly comprehend how your business operates and assess the performance of its financial systems. It allows us to identify areas for improvement and provide valuable insights on enhancing your business's performance. As an auditing firm in Dubai and the UAE, our top priority is efficiency. We dedicatedly minimize any disruptions to your business operations throughout the audit process. Our organized and streamlined auditing processes aim to ensure a smooth and effective audit. We implement these procedures with the goal of minimizing any disruption to your day-to-day business activities.

Why You Should Consider Installing

Emerald Software stands out for VAT services due to its expertise in tax compliance, reliable support, and a user-friendly interface, ensuring businesses can efficiently manage their VAT obligations

while minimizing the risk of errors and penalties.

Technology Automates VAT Filings

Our specialized solutions relieve your employees of administrative burdens, allowing them to concentrate on your core business operations.

Expert Knowledge & Full Compliance

Our dedicated account team ensures timely compliance, eliminating penalties and legal issues.

Continuous Updates

Given the constant evolution of global VAT laws, our experts keep you well-informed about all developments.

Scalable Solutions

Our complete VAT services are seamlessly integrated. They are designed to offer your business flexibility, ensuring you can easily leverage our comprehensive offerings.

VAT & Auditing - Our Advantages

Emerald stands as a prominent provider of VAT and auditing services, boasting a range of strengths that distinguish us within the industry. As FTA-registered tax agents, we possess a proven track record in delivering exceptional pre-audit and post-audit support. Our extensive expertise in VAT and auditing has forged a reputation for reliability and excellence. Clients can rely on us to adeptly navigate the intricacies of tax regulations, offering comprehensive assistance throughout the audit process to ensure compliance and minimize risks. By adhering to this checklist, we leave no room for errors or inaccuracies within UAE VAT laws, thereby mitigating compliance concerns. Furthermore, our skilled tax auditors excel in providing adept documentation assistance, simplifying VAT compliance for our clients.

6k

Consultation

6k+

Happy Clients

6k+

Project Done

The Best Audit Services Provider in Dubai, UAE and Middle East.

Start for free

Pay as you Grow

We harness the power of our precise and comprehensive VAT audit checklist, which furnishes us with a structured framework for conducting tax audits. This checklist serves as a guiding roadmap, ensuring the thoroughness of our audit process. Seamlessly process your auditing with us. Contact us right now for a free consultation.

Available on

Exclusive Price Just for You!

What our clients

say about us

Their efficient and user-friendly platform simplifies VAT compliance, saving time and reducing errors.

Emerald Sofwares' VAT services offer peace of mind, with their responsive customer support and accurate reporting. A dependable partner for all your VAT needs.

VAT services by Emerald Sofwares provide comprehensive support, making it easy to navigate the complex world of taxation.

Emerald Sofwares' VAT services are a reliable and cost-effective solution for managing VAT obligations.

From our blog

Obtain the most up-to-date information on

accounting and IT solutions from Emerald Software.

Vey Good Support Services from Emerald Software.